The tax systems of developed countries are as a rule very stable and larger changes are made over a long time. However, the world does not stand still. Several trends are undermining tax bases and tax receipts, while an ageing population will need more to be spent on social security.

The following trends affecting tax revenues in European countries including Estonia:

- The popularity of self-employment is increasing, and this is reducing receipts of labour taxes, especially social tax.

- Labour taxes are becoming less able to fill the state coffers as the working age population diminishes and automation increases.

- Widening inequality of assets is increasing dissatisfaction in society, which is increasingly expressed in obstruction of economic reforms and of major projects, holding back long-term economic growth and tax receipts.

- The climate crisis and the European Union’s green transition are increasing the role of environmental taxes in tax receipts, but the revenue received from them will decline as emissions decline.

- New digital solutions in tax administration through real-time taxation are reducing the administrative burden and the need for auditing. Offsetting taxation against benefits, by reducing individual income tax liabilities by the amount due in state benefits for example, could substantially cut the administrative expenses of the state.

These trends lead to several questions about tax policy:

- Is it reasonable in the longer perspective to tax income from work differently to other sources of income?

- Should property taxes be a more important source of tax revenue than previously, given new ways of accounting for assets such as blockchain technology, and international efforts to promote information exchange and increase the transparency of taxation?

- How can the negative effects of high environmental taxes on people’s livelihoods and the competitiveness of businesses be mitigated?

- How can new, more future-proof tax bases be found? Will data be taxed in future, as they are one of the main resources in the economy of the future and using them can have harmful side effects? Or should robots and artificial intelligence solutions be taxed, given that they will create the value in the economy of the future that was previously created by human labour?

Comparison of the Estonian tax structure and those of other European Union countries:

- Consumption taxes play a larger role in the Estonian tax revenues than they do on average in Europe, providing 42% of tax revenues in Estonia in 2019 and 28% in the European Union on average.

- The tax burden on labour in Estonia is similar to the European Union average.

- Taxes on capital are a much smaller share of tax revenues in Estonia. Estonia taxes capital at one third of the average level of the European Union.

Following from these trends and key questions, this report lays out three different future scenarios for the tax system in Estonia:

- A digital world

- An equal start

- Environmental crisis

Each scenario focuses on one major challenge facing the tax system, these being adapting the tax system for the digital age, alleviating inequality, and supporting the green transition. In the real world the state will face all these three challenges at once, not each individually, and the different scenarios will need to be combined.

A digital world

The digital world scenario asks how the tax system can adapt to the digital age. The outcomes sought from tax changes are a more equal distribution of the tax burden between those earning income from work and those earning from capital, given the spread of self-employment, and finding sources of funds that can cover the increasing social costs of an ageing population in a digital age.

These goals suggest the following changes:

- Setting a rate of 30% for traditional corporate income tax.

- Raising the personal income tax rate to 30%.

- Raising the tax-free threshold to 1.25 times the minimum wage.

- Cutting the social tax rate to 13%.

- Introducing a real estate tax.

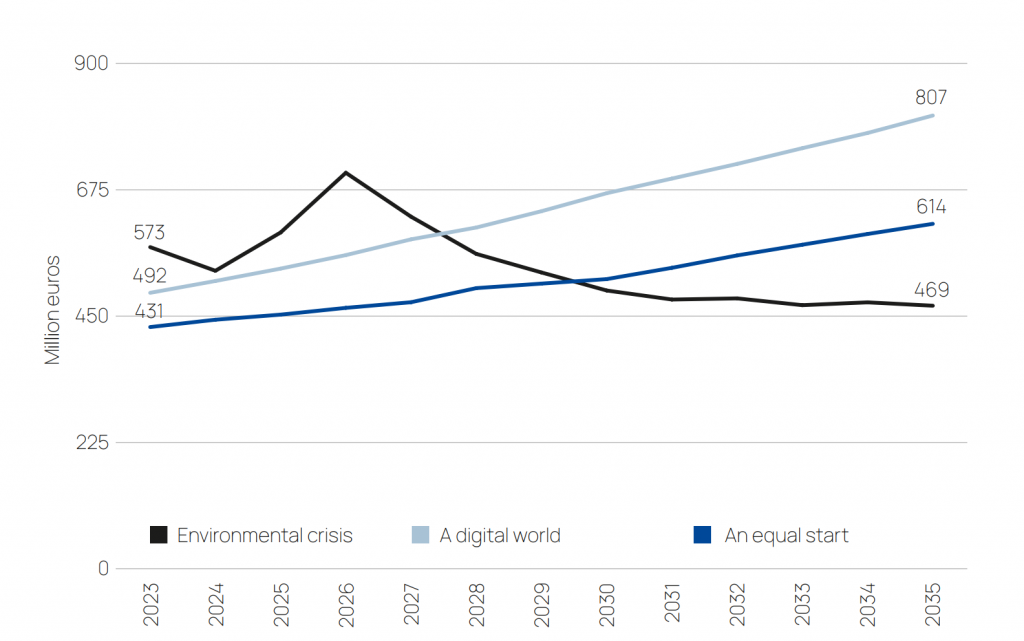

These tax changes would bring the state additional income of more than 490 million euros in 2023, and 807 million euros in 2035. The tax burden would be larger by around 1.4% of GDP by 2035 than if the tax system of 2021 were maintained, at 37.0% rather than 35.6%.

An equal start

The equal start scenario asks how the tax system should react to deepening inequality in wealth. The outcomes sought from the tax changes are a reduction in inequality and the productive use of idle real estate. The additional income from property taxes could be used to fund a deepening deficit in the social system and to invest in meeting climate goals.

These goals suggest the following changes:

- Introducing a property tax.

- Making income tax progressive.

- Setting a ceiling for social tax.

These tax changes would bring the state additional income of more than 430 million euros in 2023, and 600 million euros in 2035. The tax burden would be larger by 1% of GDP by 2035 than if the tax system of 2021 were maintained, at 36.6% rather than 35.6%.

Environmental crisis

The environmental crisis scenario asks how the tax system could be made appropriate for the green transition. The outcomes sought from the tax changes are powerful encouragement for both businesses and households to make environmentally conscious choices, while at the same time encouraging the development and export of green technologies and avoiding threats to livelihoods.

These goals suggest the following changes:

- Introducing a car tax.

- Extending the Emissions Trading Scheme to transport and to construction and housing.

- Setting a traditional corporate income tax of 15% and granting tax credits for research and development work.

- Linking the tax-free threshold for personal income tax to the minimum wage.

These tax changes would bring the state additional income of more than 570 million euros in 2023, and 460 million euros in 2035. The tax burden would be larger by 0.8% of GDP by 2035 than if the tax system of 2021 were maintained, at 36.4% rather than 35.6%.

Figure. Additional tax receipts under different scenarios above those from the current system, 2023-2035

Source: Calculations of the Foresight Centre

An independent think tank at the Riigikogu

An independent think tank at the Riigikogu