Estonian residents give little thought to their future. Many lack the means or skills to make smart investments for the future.

Incomes

The analysis showed that the incomes of Estonians have almost doubled when compared to 2007. The economic crisis however effected the income of almost all Estonians. Recovering from the crisis took several years. Income normally comes from several sources. People with higher income are more likely to have more than one job. That is mostly because they tend to have more opportunities in the labor market. The income of men has consistently been higher and the income of women lower than the average, but this gap has started to decrease. The income of younger people has been above average, but the income of people aged 40-49 has risen the most. People living in Tallinn have also consistently had higher incomes and the incomes of people living in Ida-Virumaa have stayed below average. Even though the gap between the average income of people living in Ida-Virumaa and the overall average income has shrunk, the difference is still noteworthy. On average, people whose native language is Estonian, have higher incomes than others.

Assets

Many Estonians are homeowners, many people even own more than one real estate object but the incomes from rent tend to be rather modest. In addition to that, it is important to keep in mind that owning real estate in a remote area is often more of an additional expense than an income source since the upkeep costs are high, but the selling potential is often poor. Even more, the percentage of younger people who own real estate has decreased. The percentage of homeowners is the highest amongst people who are retirement age. Most Estonians do not have financial assets and when they do, the value is often significantly lower than the value of the real estate they own. Households do not have a lot of financial backup. However, the percentage of people who have some financial assets has risen in all groups. Men receive income from financial assets more often than women do, but women have started to invest more and more. The probability of receiving income from financial assets grows with income levels. Less and less people invest in the third pension pillar. There has been also been a significant decrease in younger people (aged 25 – 39) who invest in the third pension pillar.

Consumption

The average consumption expenditure has constantly risen. Income has the highest effect on consumption – when income rises, consumption goes up and the opposite is true as well – people cut back on consumption as much as possible when the times get rough. It rings especially true with expenditure on food. However, some expenses are unavoidable. For example, people cannot save on housing costs and health costs most of the time. On the other hand, people benefit from economies of scale when it comes to housing costs, which means that the housing costs per person decrease when there are more people in the household. This is because these costs are often not individual – the cost of heating tends to be quite similar both when one people is living in an apartment or a house and when there are more people. This is also somewhat the case with food costs. The consumption expenditure has risen more in Estonian-speaking households and the gap with other households has increased. The consumption expenditure has risen the most in single parent households. The

consumption expenditure of retirement-aged people has constantly been below the average.

Consumption expenditure has risen the most within households belonging in the two lowest income quintiles. There is a pattern that the poorer the household, the higher the percentage of income spent on housing and food is.

Saving/Investing Capability

People with higher income have reported more often that they have savings. However, higher income does not automatically mean that savings increase. When income increases, consumption increases as well, at least until some level of saturation is achieved. Single parents have the least left of their income after consumption expenditure and their situation has gradually gotten worse. The most is left after consumption expenditures in households with at least two grownups (both when they have children and when they do not) and in households with two retirement-aged people but the amount left has decreased.

Perceived Well-being

Although objective indicators (the rise in income levels that has been quicker than the rise of prices) show that the life of people living in Estonia has gotten better, it does not mean that people perceive it this way. People living in Estonia are quite negative – a lot of people feel like their financial well-being is low or gotten worse. On the other hand, the percentage of people who feel like their financial well-being has gotten worse, has decreased in recent years. People, who do not speak Estonian as their native language, feel more often that they have difficulties with getting by. The lowest ratings of financial well-being come from Ida-Virumaa. Younger people are more positive about their financial situation but the percentage of older people who have reported that they have significant difficulties with getting by, has decreased.

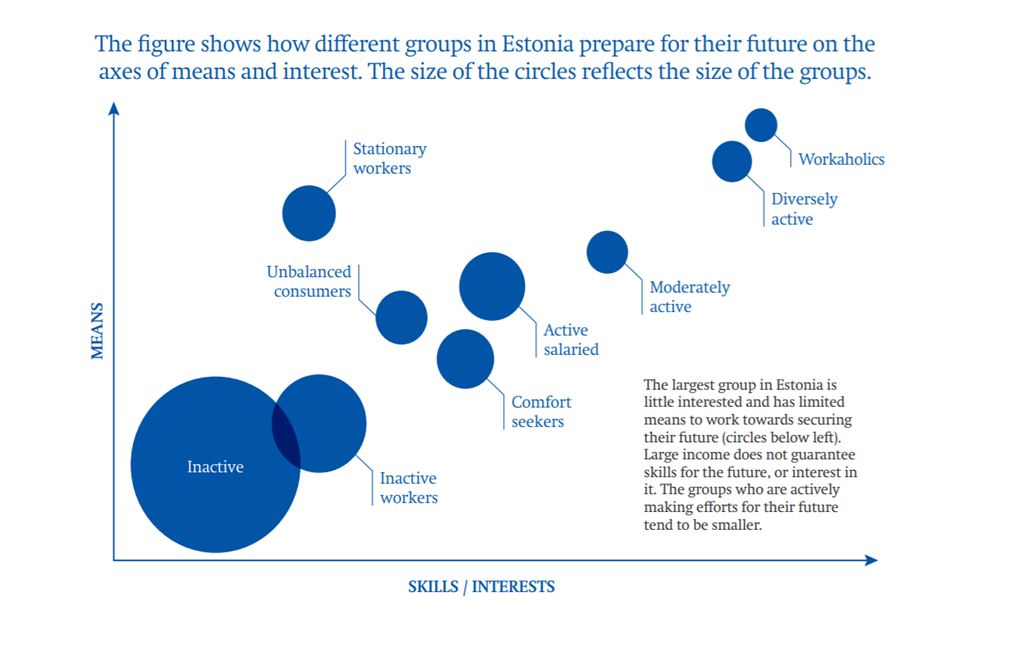

The analysis shows that groups that are more capable of saving for retirement are also more financially literate. However, it cannot be assumed that financial literacy is the reason that people save or invest. Financial literacy supports saving and investing if it is combined with everyday actions and personal lifestyle ambitions. Groups whose lifestyle supports individual actions for securing one’s well-being in the older ages are very small. Within the others, there are a few who could perhaps follow the discussions on this topic but there are many more who lack the interest and knowledge to even do so. There is a link between increasing one’s financial literacy (through educational programs for example) and saving and investing but that is mainly because people who are entrepreneurial and generally more active and who need and search this kind of information are also more receptive to it. Therefore, the obligation and desire to plan one’s retirement cannot be forced on all social groups. A person’s financial decisions are very much affected by their current stage of life. Personal desires and plans keep changing with age and so do the expectations and norms in the society. For this reason, it could be that the right time to encourage people to plan for their old age is not before the mid-age.

Income level is definitely very important when it comes to saving and investing. People, who have more money in their hands, also have more opportunities to save. For people who are struggling to get by, saving money can be very difficult. However, between these two extremes, there is a lot of grey area. Insufficient skills could hold back people with higher incomes and the other way around. The skill to make smart financial decisions develops with making small everyday decisions. It could also decrease when the need to take these kinds of decisions decreases as well (in the last stages of life for example).

In some groups, the role of independent factors (factors that do not depend on the will of a person) is bigger than in other groups. For example, for people who struggle with their health, it is much more difficult to secure one’s financial well-being for the old age. Living in a less developed area could also be an important limiting factor.

Although it is quite common for people in many groups to save small amounts for personal life-projects, outside factors and changes in their environment (inflation, retiring or becoming unemployed, and decrease in income) play a big role in most of their consumption habits. Most of the time people start saving when life forces them to. For that reason, it is important that saving and investing solutions were institutionalized and especially suitable for the more passive groups who tend not to be capable or interested in making these complicated decisions themselves. There could then be variations to these solutions that are more suitable for the small groups of people for whom saving is a lifestyle or professional ambition.

An independent think tank at the Riigikogu

An independent think tank at the Riigikogu