People will have more responsibility for their welfare in the old age. Ways of coping that are not part of the national pension system become important.

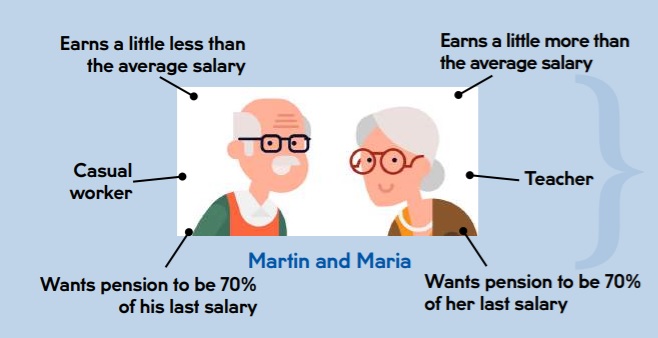

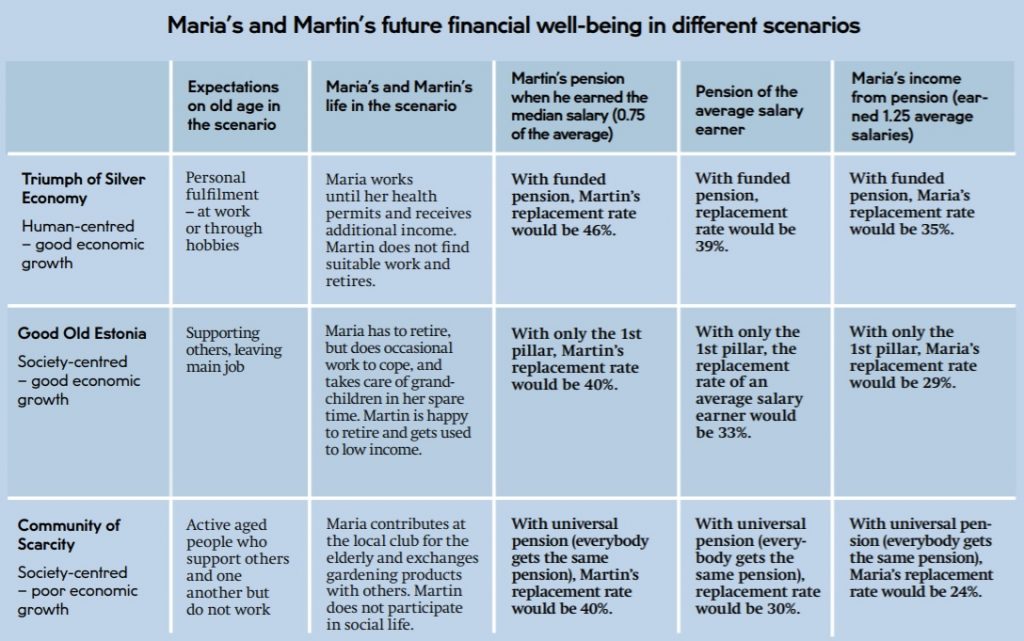

Maria and Martin were both born in 1980, and they will be retired by 2050. We have created three scenarios for old age in the future: “Triumph of Silver Economy”, “Good Old Estonia” and “Community of Scarcity”. They differ by their comprehension of old age and the pension system. The calculations at each scenario show how Maria and Martin are doing, and how they could get larger pension.

Triumph of Silver Economy

Emergence of values relating to self-expression, good economic growth, diversified choices in pension system and the services meant for the elderly, high social confidence, high achievement values and personal responsibility, increasing inequality and weakening social cohesion.

Good Old Estonia

Society-centred, deepening of coping values and materialism or “consume now” attitude, good economic growth, low trust and tolerance – but possible greater sense of belonging and unity as society.

Community of Scarcity Society-centredness, increase of communitarian lifestyle; low economic growth; uniform services provided by the state and equal state pension to all; additional community-based solutions and provision of people-to-people services via sharing economy platforms.

What are the ways of coping that are not part of the retirement system?

- Saving and investing at the individual level. If you want to live decently as a pensioner, you have to save more during working age. Everyone will become their own investor, insurer and insurance mathematician.

- Today the people of Estonia lack the necessary possibilities, interest and abilities. Only 2.3% of the population of Estonia received income from shares, funds or bonds in 2017. 91% of the people of Estonia generally have at least one real estate object, but among younger families, the number of those not owning any real estate objects is increasing.

- In order to receive a pension that covers 70% of the pre-pension salary, a person receiving an average salary should every month invest 18% of their income into the second or third pension pillar, or in some other way. In 2050, the average salary will be around 5000 euro.

- Keeping your skills and knowledge up to date and taking care of your health to increase the number of years spent working. Financial well-being depends on economic growth, which requires the optimal employment of people throughout their whole lifetime.

- Changing labour market has an increasing role in retraining and refresher training. Unfortunately, the elderly and the people with lower level of skills are more passive in lifelong learning.

- In 2018, the estimation of the healthy life years of the people of Estonia dropped – men live healthily for 52.8 years and women for 55.6 years.

- Other ways of coping: support of the family, support of the community, cooperative activities, sharing economy. Requires strengthening of family and community ties.

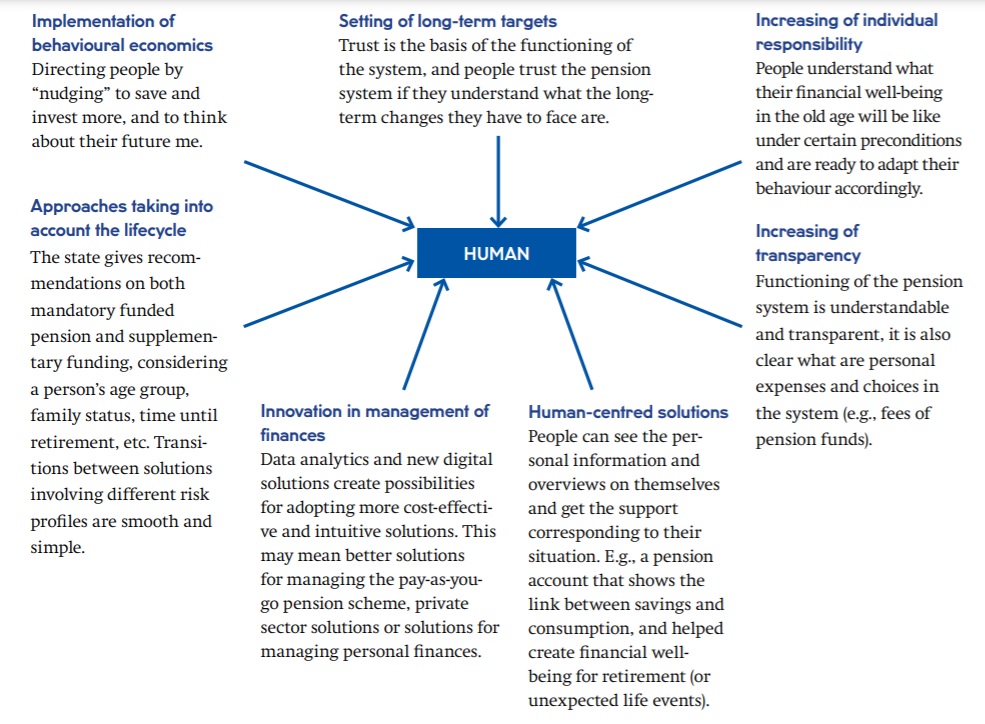

How can the state support people in making better decisions for their future?

Additional information:

An independent think tank at the Riigikogu

An independent think tank at the Riigikogu