Report: The gap in local government revenues is growing again

After the administrative reform, the differences in the revenues of the so-called wealthy and poor municipalities decreased and the income per resident significantly increased. Today, however, the gap between municipalities is widening again, according to the Foresight Centre’s short report ‘Trends in local government revenues’.

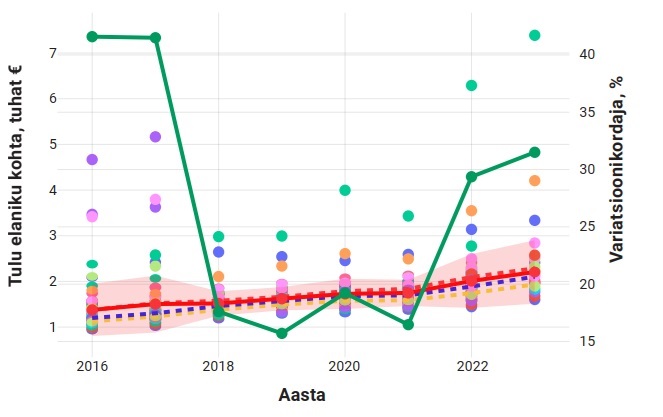

Märt Masso, expert of the Foresight Centre, said that the administrative reform of municipalities equalised the municipalities’ incomes per resident, helping those who were lagging behind to catch up. “As a result of the administrative reform, the differences between the revenues of municipalities were reduced by half, but the gap has been widening again in recent years, and if current trends continue, it will take a decade for those who have fallen behind to catch up again,” said Masso. He recognised that the large gap in revenues limits the ability of many municipalities in Estonia to provide public services today.

As a result of the administrative reform, the gap between the municipalities with the highest and lowest revenues decreased by half. For example, if there was a five-fold difference between the revenues of the wealthiest and poorest municipalities per resident in 2016, the difference had decreased to 2.5 times by 2021. Today, however, the difference between the municipalities with the highest and lowest revenues has significantly grown again, amounting to a 4.6-fold difference.

“The reason for the gap could be the end of merger subsidies as well as varying levels of economic development in regions bringing more income tax revenue to regions that are economically more active,” said Masso.

Today, the lion’s share of municipalities’ revenues comes from the state-regulated personal income tax and a smaller part consists of state grants, local taxes and sales revenues. The Foresight Centre reveals that although the objective has been to diversify the revenues of municipalities, the structure of the revenue sources has not changed much. The share of autonomous revenues, which depend on the choices and decisions of the municipalities, continues to be small.

The Foresight Centre points out in the report that the revenue autonomy of Estonian municipalities is also low compared to other countries. In 2023, autonomous revenues such as land tax, local taxes and operating revenues made up an average of 12% of the total revenue of municipalities in Estonia, whereas the same indicator is 43% in the European Union as a whole. The share of autonomous revenues in Estonian municipalities has even declined over the years, dropping from 14% to 12% according to the mean value. Additionally, the share of autonomous revenues fluctuates widely among municipalities, between 5% and 39%, while three quarters of municipalities fall below 14%.

The short report ‘Trends in local government revenues’ (in Estonian) is part of the Foresight Centre’s research stream ‘The Future of Spatio-temporal Accessibility of Public Services’. The purpose of the research stream is to map the availability of public services now and in the future and find which models of service provision could be the most beneficial in the future.

Latest news

-

16.01 2026Study: The transition to Estonian-language-based education has led Russian families to use the help of private tutors

Hiring private tutors is widespread in Estonia. According to the study by the Foresight Centre, “The Use of Private Tutors in Estonia”, the need for private tutoring is greatest in Russian-speaking families, where private tutors are hired more than twice as often as in Estonian-speaking families.

An independent think tank at the Riigikogu

An independent think tank at the Riigikogu