Productivity scenarios describe the potential changes in global value chains and what these entail for Estonian companies, the development of their business models, strategic decisions, and cooperation. These also give an indication of the risks and opportunities inherent in each development avenue. The scenarios can be useful when designing policies that support business and productivity growth, mitigate possible risks and address the challenges that could arise in different scenarios.

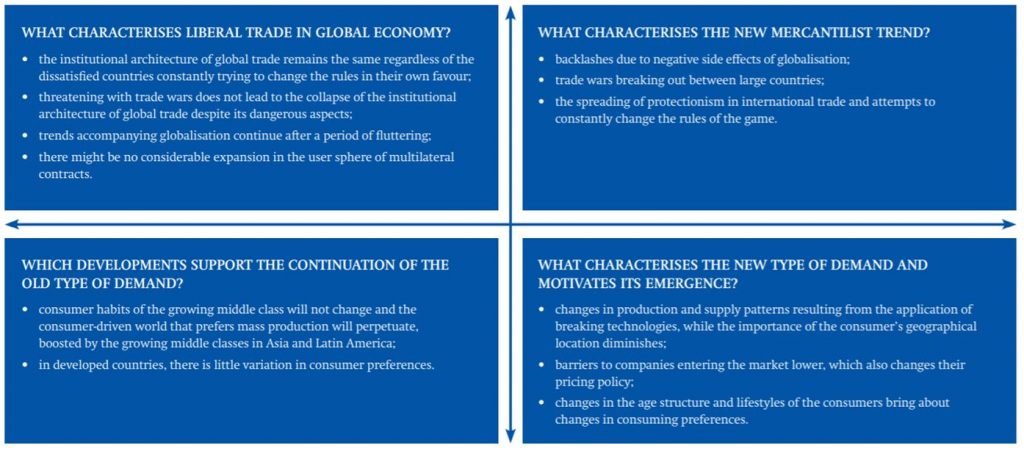

As an open economy, Estonia is sensitive to what is going on in global economy. This is why the scenarios give primacy to the directional developments that could possibly happen in the

global economy: first, the opposition between possible trends that would affect international trade: liberalism and new mercantilism; and second, competition and demand in global economy, between the so-called old type of demand that prefers mass production and the so-called new type of demand that prefers personalised products and services.

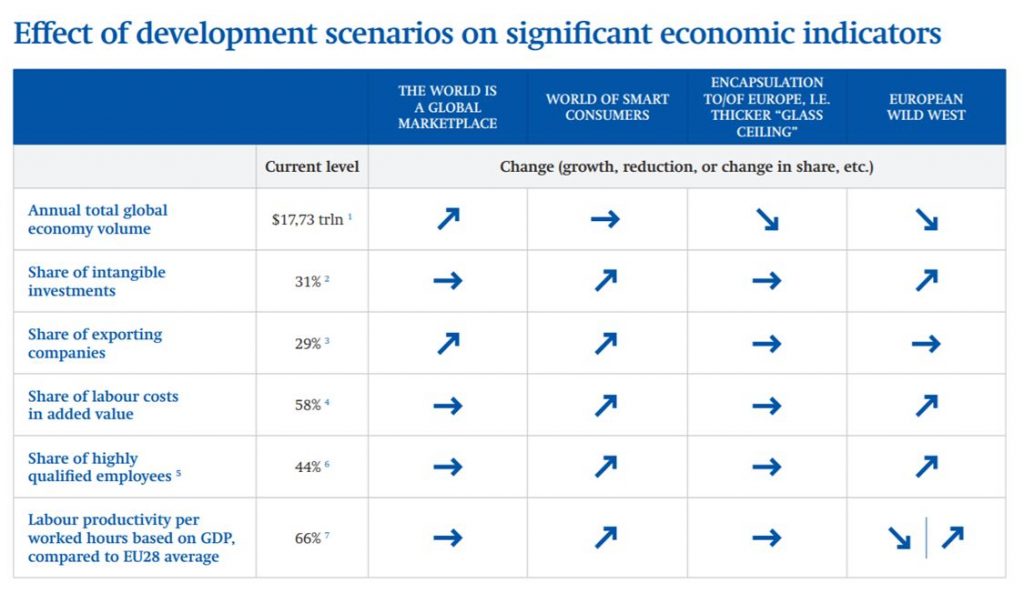

The world is a global Marketplace

Global free trade recovers and companies converge into long global supply chains, where the participation condition is cost efficiency. Asian and ohter developing markets enjoy a competitive advantage. The growing middle classes of developing countries that prefers mass production drive the demand. Estonian companies participate in the GVCs through Nordic companies that have developed supply chains with Asia. Since salaries are on the rise, more automation is required to achieve the cost efficiency required by GVCs. To increase the added value, industrial companies need to move to the level of recognised suppliers and product developers. Producers of end products are focussed on sufficiently narrow market niches where the MNEs do not operate. Demand does not support the breakthrough of innovative technology-based companies and the level of innovation remains modest in economy. In the labour market, there is the danger of being locked in old skills, there is not enough motivation to diversify one’s competence. The growth of added value tends not to increase, and convergence is moderate.

World of smart consumers

Recovering free trade and diverse and changing new type demand provide a competitive advantage to countries where the economy is more technologyintensive and benefits from updated business models. Production and services mix, platform and sharing economy spread. Supply chains become more complex. Digital platforms where the consumer communicates directly with the “factory” (e.g. 3D-printing cluster) take over increasing amounts of functions in the supply chain as well as in the organisation of payment and supply. Production in regular factories is on the decline. New demand is mainly spreading in Europe and Nordic countries, where the consumers prefer personal, functional, and environmentally friendly products and services. This enables the technology and start-up companies to obtain increasingly more relevant positions in the economic structure and they will slowly take over from the traditional industries. Small producers are supported by increasing demand for products and services with a “small footprint” and the sharing economy. Growth of added value and convergence may accelerate.

Encapsulation to/of Europe, i.e. thicker “glass ceiling”

Protectionism spreads in global economy and regions become blocks. Units of production companies move from USA to Europe and Asia, markets are reallocated, and leading companies change their supply policies and practices. The nature of demand does not change and relies on the growing middle classes of developing countries. Demand grows faster in Asia, and if the MNEs also move there, Europe is in danger of encapsulating. Estonian (and European) companies will lose their chance to do business on faraway markets because the growth there will not reach us. Many Estonian companies may lose their current positions in GVCs which served other regions. For Estonia, Europe’s role as an export market grows. The cost advantage of Estonian economy will recover partially, because production in Asia becomes more expensive, thus the subcontracting of Scandinavia and Western Europe, may partially return, häving left here due to high labour costs. This will postpone Estonia’s investments into automation and smart production solutions. Growth of added value and convergence may come to a halt.

European Wild West

Protectionism rules in international trade, trading blocks are set up, and value chains become regional. At the same time, the development of a new type of demand is thriving; its growth is supported by new technologies, demographic changes, increase in consumer awareness, and changes in attitudes. The supply chains that fed companies this far fall apart and the formation of new ones is dictated by the changed demand environment. Industries can no longer do without implementing Smart Factories. In production, just like in other sectors, we will see developing digital platforms that connect the consumers directly with production options and take over the functions of the supply chains. Without changing the business strategy there is a high risk of falling out of the competition. A lifeline for Estonian companies is the introduction of diverse technologies, contributions into research and development activities, innovation in product and service development, and orientation towards the Nordic and Western European markets where the new demand type dominates; the geographic proximity also favours moving there. Growth of added value and convergence depends on the risks (not) materialising and, thus, developments may take a different courses.

Short reports can be found HERE and HERE.

How different types of investments support productivity growth? (PDF)

How are investments by enterprises linked to their position in the value chain? (PDF)

Author: Mari Rell, expert, Foresight Centre

An independent think tank at the Riigikogu

An independent think tank at the Riigikogu