Active consumers in the future energy system. Development trends up to 2040

The Estonian electricity system is facing major changes that reflect global trends, such as electrification, decentralised generation and the open energy market. As a result, the traditional electricity systems are being redesigned.

Passive consumers of yesterday’s energy system will become active participants in the future system. Households and companies are getting increasingly involved in electricity demand management and production. Their active contribution helps to create a more efficient and environmentally sustainable energy system.

Figure 1. Electricity systems today and tomorrow

Source: Energy Atlas (2018)

- Active consumers are consumers who use innovative technologies to manage their energy consumption. Active consumers, for example, reduce their consumption during peak demand or are willing to delay consumption to a time when more energy is available in the system and on the market.

- Prosumers are active consumers who both manage their consumption and produce electricity themselves. Producing consumption means that the prosumer produces electricity to cover their own demand as well as supplies the surplus energy to the power grid to cover the demand of other consumers and receives payment or consumption credit for it.

Producing consumption has grown rapidly and it increases the energy independence of homes

Distributed generation is growing in the electricity system: many smaller producers of renewable energy join in with and partially replace large producers. According to Elering’s 2022 forecast, the amount of electricity produced by distributed generation will almost quintuple by 2050, increasing from 777 GWh in 2025 to 3,724 GWh by 2050.

Next to the large distributed producers, there is a rapidly increasing number of households that, in addition to consumption, have started to produce electricity themselves (mainly from solar energy). For example, in 2007, there was only one prosumer with a production capacity of up to 25 kW, but in 2022, there were already 9,311 of them, or nearly 2% of all households. Electricity produced by consumers currently accounts for an average of 24% of their own consumption and their production exceeds consumption for about 13% of hours per year. The driving forces behind producing consumption have been the falling prices of solar panels on the one hand and households’ expect to reduce energy expenditure, to produce and use energy more economically, and to increase the flexibility and resilience of their electricity supply on the other hand.

In 2022, prosumers produced 61 GWh of energy for the power grid and consumed 665 GWh of energy. The share of the production of prosumers in overall electricity production is still small, constituting less than 1% of Estonia’s total energy production and about 12% of the production of solar energy. Prosumers consume about 8% of the electricity consumed in Estonia.

Producing consumption will continue to grow in the future, but this will not threaten the balance of the energy system. In 2021−2022, when electricity prices were high, the growth of producing consumption accelerated, although it is expected to slow down in the next decade.

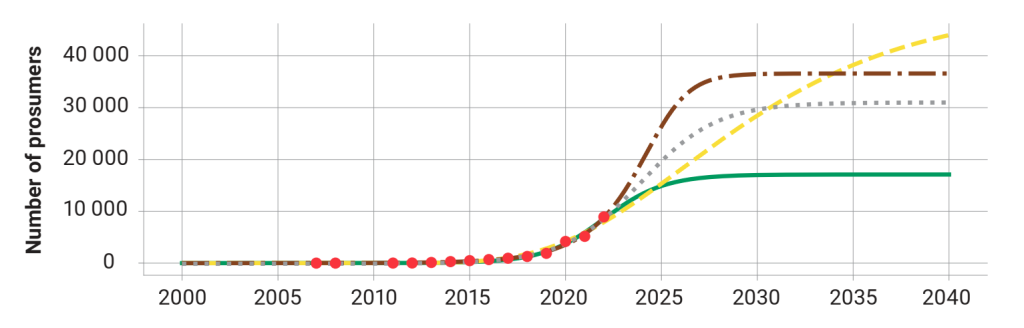

Figure 2. Forecast of growth in the number of prosumers

Source: STACC, commissioned by the Foresight Centre

It is estimated that there will be 2−4 times more prosumers in Estonia in 2040 than today, i.e. between 17,102 and 43,994 prosumers, who will also produce and consume 2−4 times more energy than now, i.e. 111−202 GWh and 1219−2208 GWh, respectively. However, since Estonia’s general electricity production and consumption will grow in a similar order of magnitude according to current forecasts, the share of electricity produced and consumed by prosumers in the total electricity production and consumption is not expected to increase, so their impact on the energy system will not change significantly even in the long term.

The following aspects and energy policy steps would promote the growth of producing consumption.

- Technology development and cost-effectiveness: solar panels should become more and more efficient, the possibilities of integrating them into other materials (such as roofing) should widen and their cost-effectiveness should improve. Also, the service life of battery storage should increase and their cost-effectiveness should improve.

- Electricity price: the market price of electricity should allow producing consumption with reasonable profitability. Among other things, the price should be high enough that the production of energy to cover own consumption and to sell energy to the grid would be cost-effective even in periods with higher solar energy generation.

- Connecting to the power grid: connecting to the distribution network should be easy and affordable for prosumers, i.e. the obligation to bear the development costs of the network should not rest entirely on the individual party. The tariffs for using the network services should not inhibit producing consumption and participation in system services, such as demand management.

- New operating models: for example, energy cooperatives, person-to-person energy market, aggregation or rental of production and storage facilities. These are just some of the emerging operating models that would expand consumers’ opportunities for profitable producing consumption.

Active demand management, including energy storage in local batteries, would help prosumers smooth out the intraday uneven solar energy generation and increase the share of their self-consumption. Battery technology and their cost-effectiveness still have plenty of room for improvement. However, even now, when solar energy is produced in combination with batteries, the payback period of batteries is significantly reduced compared to when batteries are used separately for demand management, for example, from 15 years to 5 years with a storage capacity of 5 kWh. The lower prices of battery systems help active consumers and prosumers manage their consumption and in turn, contribute more to system stability.

The rising producing consumption is a double-edged sword for the energy system: on the one hand, it offers additional emission-free production capacities and reduces the overall energy consumption by the energy not used in the distribution network, while on the other hand, it can destabilise the system, as it adds more energy to the network in surplus hours and additional consumption (which it covers by itself at other times) in hours with a deficit. However, as long as the addition of producing consumption keeps pace with the growth of total production and consumption, it does not threaten the stability of the system and does not require extra storage or management capacities in the system.

Demand management is on the rise, but there is potential for much more

In the past, production and consumption have been balanced primarily by energy supply, by increasing or decreasing electricity production. In the open energy market, with a growing share of unmanaged energy production and consumption peak demand, it is more and more important to smooth out consumption peaks and ensure the balance of the system by managing demand. The more there are peaks of high demand with higher prices, the more consumers become price-sensitive and willing to manage their consumption. Recent trends show that the volume of consumption peaks has soared: In 2020 and 2023, the peak volumes were 75.4 MWh and 105.7 MWh, respectively. The number of active consumers who consciously reduce their consumption when electricity prices are high is still small on the Estonian electricity market: In 2021 and 2022, 3320−7078 consumers reduced their electricity consumption according to electricity prices.

In Estonia, there is a potential to reduce consumption by 75−100 MW in total during hours with extremely high prices (approximately 1500 €/MWh) in winter. This is about 6% of total consumption (peak consumption is about 1.6 GW in Estonia). Consumers are becoming more and more knowledgeable about managing their consumption during price peaks. For example, on 7 December 2021, active consumer groups who bought electricity at power market prices reduced their consumption by 2−4% during hours with ultra-high prices, but on 5 January 2024, household consumers and companies in the manufacturing industry reduced their consumption by 10−12%. Prosumers are among the most exemplary in demand management, reducing consumption among household consumers by almost 2.5 times. However, due to their small share (8% of total electricity consumption), they have little impact on the balance of demand and supply.

Currently, only consumers who pay power market prices participate in demand management, but the introduction of aggregation services on the market would allow consumers paying a fixed price to get involved as well. In the case of aggregation services, consumers who have reduced their consumption (or increased it during hours with cheap electricity prices) would be paid a bonus for this depending on the prices in the regulatory market. Thus, there would be a potential to reduce consumption by another 25 MW. For this, the Electricity Market Act would need to be amended by adding business models based on the aggregation of consumption capacities and a regulation market directive to it.

In the future, the following factors would increase active consumption and demand management:

- an increasing number of price-sensitive active consumers who prefer contracts with variable electricity prices and are prepared to change them and to participate in aggregation services where the service provider brings together different consumers and, if necessary, increases or decreases their consumption depending on the energy price;

- tight competition in the electricity sales market and a low market concentration, which allows for the introduction of demand management services and getting more households and other economic units involved in demand management, as well as ensures the flow of data necessary for the aggregation of consumption and production;

- improved cost-effectiveness and wider use of technologies that allow active and producing consumption, including storage technologies, heat pumps, electric vehicles and their charging and demand management automation technologies.

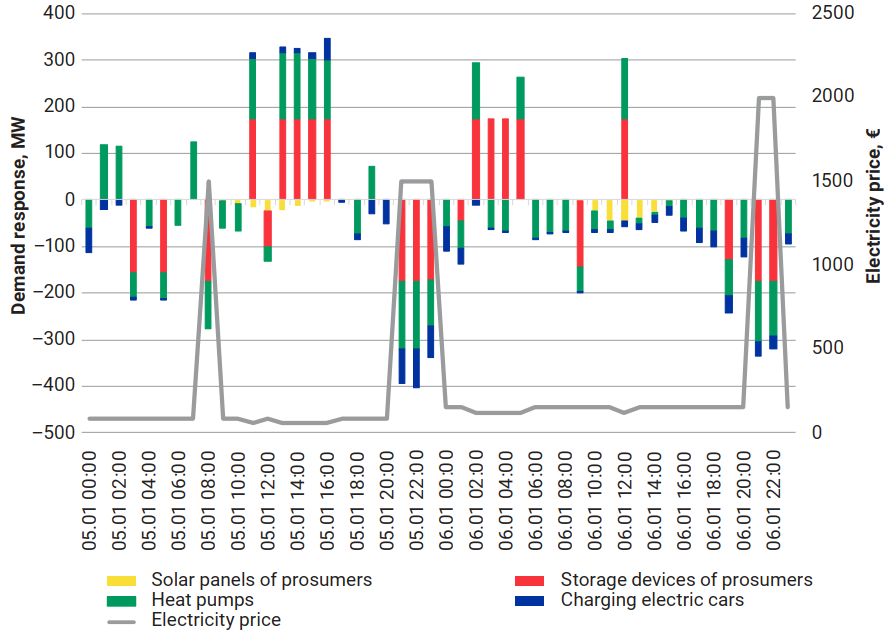

The wide-spread use of smart electrical devices, storage technologies and aggregation services significantly increases the potential volume of demand management in the electricity system, helping to flatten demand and price peaks as well as improving the overall efficiency of the energy system. Assuming we will have around 35,000 active consumers in 2040, the potential for demand management could reach around +/− 400 MW if the price of electricity exceeds the 1500 €/MWh mark. Of this, approximately +/− 175 MW is the demand management volume of production and storage by prosumers, +/− 145 MW is the demand management volume of heat pumps and +/− 80 MW of charging electric cars.

Figure 3. The potential of demand management in 2040

Source: Tallinna Tehnikaülikool (2024)

The possible volume of demand response is affected by the duration of high-price periods. During a long-lasting (i.e. several hour) high-price period, it is not possible to continuously underload all devices or consume only stored energy.

If automated solutions become predominant in demand management, i.e. a number of smart electrical devices shift their consumption to the same low-priced hours, new peaks appear in load and price schedules and day-ahead pricing becomes inaccurate. In these peak hours, the system operators need to purchase reserve power, thereby raising the price of electricity.

To summarise, the role of the demand management is growing in the energy system. In terms of policy making, the Electricity Market Act would need to be amended by including business models based on the aggregation of consumption capacities and a regulation market directive. This would, among other things, allow customers subscribed to a fixed electricity price to participate in demand management.

Network tariffs will become a significant factor affecting the energy market

In yesterday’s electricity distribution network, a small number of central producers had a one-way connection to consumers. Step by step, we are moving towards the development of a more dispersed, two-way distribution network with many active customers, where consumers can return the excess energy they have produced or stored back to the system and take the energy they need at times of shortage from the system.

According to the base scenario of Elektrilevi’s investment forecast, the base need for distribution network development investments is 1390 million euros in the years 2024−2035. If, in addition to the base scenario, the necessary developments to increase the capacity of production and consumption will be made, an extra 670 million euros will be needed. Thus, in this period, the need for annual average investment is 172 million euros in total (in 2023, Elektrilevi invested about 167 million euros).

The current network tariffs and their structure are not sufficient to cover investments, including creating connection opportunities for dispersed prosumers. According to Elektrilevi’s forecast, current network tariffs would cover an estimated 44% of investments in the period of 2023−2035. If we also take the investments to increase production and consumption capacity into account, the network charges cover approximately 35% of the investments.

Therefore, we can predict that the prices of network services and their share in the energy prices will rise. The general rise of network charges, which we can foresee due to the large investment requirement of the distribution network, can increase the cost-effectiveness of producing consumption, since the network charges are calculated based on the amount of energy supplied to or taken from the network: producing consumption, while reducing dependence on the distribution network, also reduces households’ expenditures on network charges. However, if network charges are applied according to production or storage capacities – unlike the current practice of calculating them based on the amount of energy produced and consumed – then this may discourage producing consumption, as its cost-effectiveness may decrease.

There are often conflicting goals to consider when designing network tariffs. Ideally, network charges should be made up in a way that they cover the costs of the electricity network and support the efficiency of the power system as a whole, instead of supporting one segment of consumers at the expense of others. On the other hand, it may be reasonable to use tariffs to amplify price signals that would encourage network users to become active consumers. To control consumption, additional incentives can be created with time-varying network charges that would rise during periods of peak demand and fall when the demand is low.

Encouraging electricity storage helps to prevent costly grid development. Grid-connected storage capacities and systematic management of their cycles help to stabilise demand and supply and frequency in the grid. A network tariff structure that encourages electricity storage, which, among other things, takes into account the revenues and costs of storage in the system, stimulates a wider use of storage devices. An active consumer who uses a 5 kWh battery can, for example, save about 100−150 euros per year if they store energy taken from the grid and if the network charges are eliminated.

An independent think tank at the Riigikogu

An independent think tank at the Riigikogu